For travelers around the world Dubai and Abu Dhabi are the most famous tourist attractions, no matter you are on vacations or a casual business trip. The glittering malls and markets of UAE will certainly make you spend some cash on your shopping spree in UAE. But the question comes in mind how you can make the most of your shopping experience, by claiming VAT refunds in Dubai.

What is VAT Refund in Dubai and Abu Dhabi and Who is Eligible?

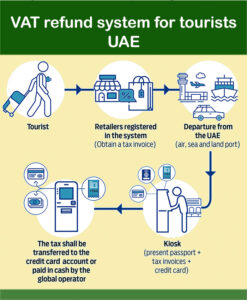

In the United Arab Emirates (UAE), tourists can reclaim Value Added Tax (VAT) paid on purchases made during their stay. This system, known as the tourist refund scheme UAE, is designed to enhance the shopping experience for visitors. To be eligible, you must be a non-resident, at least 18 years old, and not a crew member on a departing flight or vessel. Purchases must be from retailers participating in the scheme, and the goods should be intended for export and not to be consumed within the UAE.

VAT Refund for Tourists in the Dubai: A Complete Guide

The UAE VAT refund policy allows tourists to reclaim a portion of the VAT paid on eligible purchases. The process is facilitated by Planet (VAT operator company) in collaboration with the Federal Tax Authority (FTA). Tourists can recover up to 87% VAT reclaim, with a fee of AED 4.80 deducted per tax-free tag. The refund can be collected in cash (up to AED 35,000 cash limit) or credited to a card. Refunds are processed at VAT refund validation points located at almost all airports, seaports, and land borders across UAE.

How to Shop Tax-Free in the UAE: Tourist Shopping Tips

To claim VAT on shopping in Dubai and Abu Dhabi , ensure you shop at retailers displaying the “Tax-Free” sign, indicating their participation in the tourist refund scheme. At the time of purchase, present your passport to receive a tax-free receipt. Keep all receipts and digital tax-free forms safe, as they are required for the refund process. Remember, the minimum purchase for VAT refund is AED 250.

Documents Required to Claim VAT Refund in Dubai

When preparing to claim VAT on your shopping in UAE, ensure you have the following documents: your original passport, the digital tax-free form, the tax-free receipt, and the purchased goods. These are essential for the validation process at the point of departure. Without these, the refund cannot be processed.

How to Claim Your VAT Refunds in Dubai – Step-by-Step Process

To initiate the VAT refund process in Dubai or Abu Dhabi, follow these steps, visit the VAT refund validation points at your departure location. Present your documents and goods for inspection. Once validated, choose your preferred refund method: cash (up to AED 35,000 cash limit) or card. The refund will be processed accordingly.

VAT Refund Validation Process: What You Need to Know

The validation process is crucial in the United Arab Emirates. It involves verifying your documents and goods at manned validation desks or self-service kiosks. Ensure you complete this process before checking in your luggage, as the goods may need to be inspected. Also, be aware that the goods must be exported within 90 days of purchase.

Methods to Request VAT Refund: Online and In-Person Options

Tourists can request refunds either at self-service kiosks or manned validation desks located at departure points. The refund can be received in cash, credited to a card, or transferred to a WeChat wallet refund. Choose the method that best suits your convenience.

Where to Collect VAT Refunds in Dubai – Airport and Retail Locations

VAT refund validation points are available at major airports like Dubai International Airport, seaports, and land borders such as Al Ghuwaifat land border. These locations are equipped with self-service kiosks and manned validation desks to facilitate the refund process. Ensure you allocate sufficient time at these points before your departure.

Common Mistakes to Avoid When Filing VAT – Ensure 0 Errors

To avoid errors in the tax refund procedure, ensure all your documents are accurate and complete. Double check that your purchases meet the minimum purchase for VAT refund and are from participating retailers. Also, validate your purchases within the stipulated time frame to avoid forfeiting your refund.

Why You Should Claim a VAT Refunds – Maximize Your Savings

Claiming a VAT refund enhances your shopping experience in the UAE by offering significant savings. By understanding the VAT refund policy in UAE and following the correct procedures, you can make the most of your purchases. Remember, the tourist refund scheme UAE is designed to benefit you, so take advantage of it.

you may also like to read : How to Book Cheap Flights: 10 Smart Tips to Save Big on Airfare

3 thoughts on “How to Claim VAT Refunds in Dubai: All You Need to Know”